When it comes to the banking industry, customer relationship management plays a crucial role in ensuring the success and growth of the institution. With the advent of technology, the way banks handle their relationships with their customers has evolved significantly. In this article, we will explore the concept of banking relationship management and how effective it is in today’s digital age.

The Importance of Banking Relationship Management

Banking relationship management refers to the strategies and practices employed by banks to build and maintain strong relationships with their customers. It involves understanding the needs and preferences of customers, providing personalized services, and creating a positive customer experience.

In a highly competitive market, where customers have many banking options to choose from, building strong relationships with them is essential for banks to differentiate themselves from their competitors. A satisfied and loyal customer is more likely to continue using the bank’s services and even recommend it to others, thus contributing to the bank’s growth and profitability.

Utilizing Technology in Banking Relationship Management

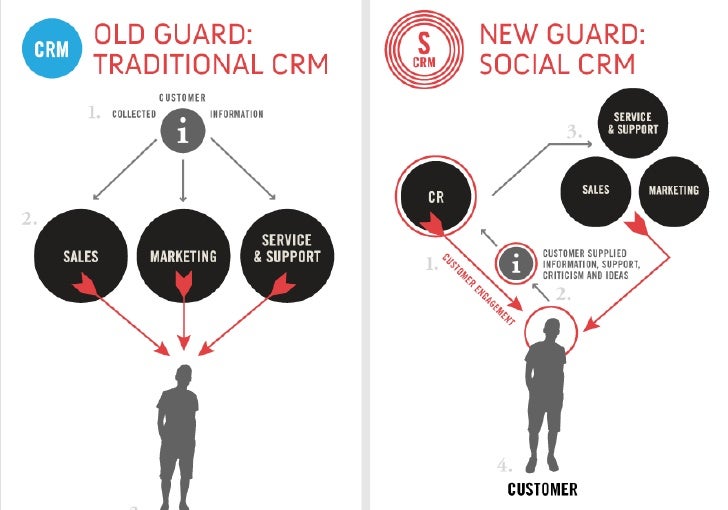

Technology has revolutionized the way banks interact with their customers and manage their relationships. With the use of customer relationship management (CRM) software, banks can gather and analyze customer data, track customer interactions, and automate various processes.

CRM software enables banks to personalize their services based on customer preferences, history, and behavior. For example, the software can send customized marketing offers to specific customer segments, ensuring that the right message reaches the right audience at the right time.

Additionally, CRM software facilitates effective communication between banks and their customers. Customers can easily reach out to the bank through various channels like phone, email, or social media, and expect quick and personalized responses. This level of responsiveness and accessibility enhances the customer experience and strengthens the relationship between the bank and its customers.

The Benefits of Effective Banking Relationship Management

Effective banking relationship management offers numerous benefits for both banks and their customers. For banks, it helps in increasing customer satisfaction and loyalty, reducing customer churn, and attracting new customers. It also allows banks to cross-sell and upsell their products and services effectively, leading to increased revenue.

For customers, effective banking relationship management means receiving personalized and relevant services, quicker issue resolution, and enhanced convenience. A bank that understands its customers well can anticipate their needs and proactively offer solutions, making banking a hassle-free experience.

The Future of Banking Relationship Management

As technology continues to advance, the future of banking relationship management looks promising. Artificial intelligence (AI), machine learning, and data analytics will further enhance the ability of banks to understand their customers and provide them with personalized experiences.

With AI-powered chatbots and virtual assistants, banks can offer round-the-clock customer support, answer queries instantly, and guide customers through complex processes. The use of predictive analytics can help banks identify potential issues before they occur and take proactive measures to prevent them.

In conclusion, effective banking relationship management is imperative for banks to thrive in today’s competitive market. By utilizing technology, understanding customer needs, and providing personalized experiences, banks can build strong relationships with their customers and secure their loyalty. As technology continues to advance, the future holds even more opportunities for banks to enhance their relationship management practices and stay ahead in the industry.

Remember to consult with your financial advisor for personalized advice tailored to your specific banking needs.

Seeking How effective is banking relationship management – Software on? you’ve came to the right web. We have 5 Images about How effective is banking relationship management – Software on like How effective is banking relationship management – Software on, Customer Relationship Management Retail Banking Ppt Powerpoint and also [PDF] Customer Relationship Management in Banking Sector and A Model. Here it is:

How Effective Is Banking Relationship Management – Software On

www.jain.software

Firms is a crucial component of the international economy. Innovators utilize opportunities to develop lucrative ventures that contribute to economic growth and job creation.

[PDF] Customer Relationship Management In Banking Sector And A Model

![[PDF] Customer Relationship Management in Banking Sector and A Model](https://d3i71xaburhd42.cloudfront.net/1247cb1eab9dcff81c5b11eb3183f7309e9bc926/7-Figure3-1.png)

www.semanticscholar.org

Business is a vital component of the international economy. Entrepreneurs leverage opportunities to develop successful ventures that contribute economic growth and employment.

Customer Relationship Management Retail Banking Ppt Powerpoint

www.slideteam.net

Entrepreneurs is a crucial factor of the international economy. Entrepreneurs leverage opportunities to establish lucrative ventures that add economic growth and job creation.

PPT – Customer Relationship Management In Banking PowerPoint

www.slideserve.com

Entrepreneurs is a vital aspect of the international economy. Entrepreneurs capitalize on opportunities to establish profitable ventures that contribute economic growth and job creation.

Banking And Customer Relationship Management

interaction-training.com

Entrepreneurs is a vital factor of the international economy. Business owners leverage opportunities to create profitable ventures that contribute to economic growth and employment.

Nowadays, tech plays a crucial role in business operations. Companies implement revolutionary tools and software to streamline processes, boost communication, and improve performance. Data analytics enables decision-making, while e-commerce systems ease online transactions and global reach.

Originally posted 2023-04-18 02:44:03.