Hello there! In this article, we are going to take you through the process of writing a check. While online payments have become more common, there are still instances where a good old-fashioned check comes in handy. Whether you need to pay a bill or give someone a gift, knowing how to write a check is an essential skill to have. So, let’s get started!

Step 1: Date the Check

The first step in writing a check is to date it correctly. Write the current date on the line provided usually located at the top-right corner of the check. For clarity, write the month in full, followed by the day and the year. Make sure the date is accurate, as a post-dated check may not be accepted by the recipient.

Step 2: Fill in the Payee Field

Next, you need to fill in the payee field. This is where you write the name of the person or the organization you want to pay. Locate the line that says “Pay to the order of” and write the name clearly. If you are paying an individual, use their full name. If it’s a company, use the official name.

Step 3: Write the Check Amount in Numbers

Now it’s time to write the check amount in numbers. Locate the box on the right-hand side of the check and write the amount in digits. Be careful with the placement of the decimal point. If there are no cents involved, you can simply write “.00” after the whole number.

Step 4: Fill in the Check Amount in Words

In addition to writing the check amount in numbers, you also need to write it in words. This helps eliminate any confusion or potential alteration of the check amount. Begin writing as close to the left-hand edge of the check as possible. If the amount is $125.25, write “One hundred twenty-five dollars and 25/100.”

Step 5: Memo Line (Optional)

Not all checks have a memo line, but if there is one, you may use it to include additional information. For example, if you are paying a bill, you can include your account number in the memo line. This helps the recipient apply the payment to the correct account.

Step 6: Sign the Check

For the check to be valid, it must be signed. Locate the line that says “Signature” and sign your name exactly as it appears on the front of the check. Make sure you have signed in blue or black ink to ensure the authenticity of the check. Unsigned checks will not be honored by banks.

Step 7: Tear Out the Check

After completing all the necessary fields, carefully tear out the check along the perforated edge. It’s essential to keep your checks secure, so be cautious when handling them. If you made a mistake while writing the check, void it by writing “Void” across it and shred it to maintain your personal information’s confidentiality.

Step 8: Keep a Record

It’s always a good practice to keep a record of all the checks you write. This can be done by making an entry in your checkbook register or using a budgeting app that tracks your expenses. By recording your check details, you ensure accurate account reconciliation and budget management.

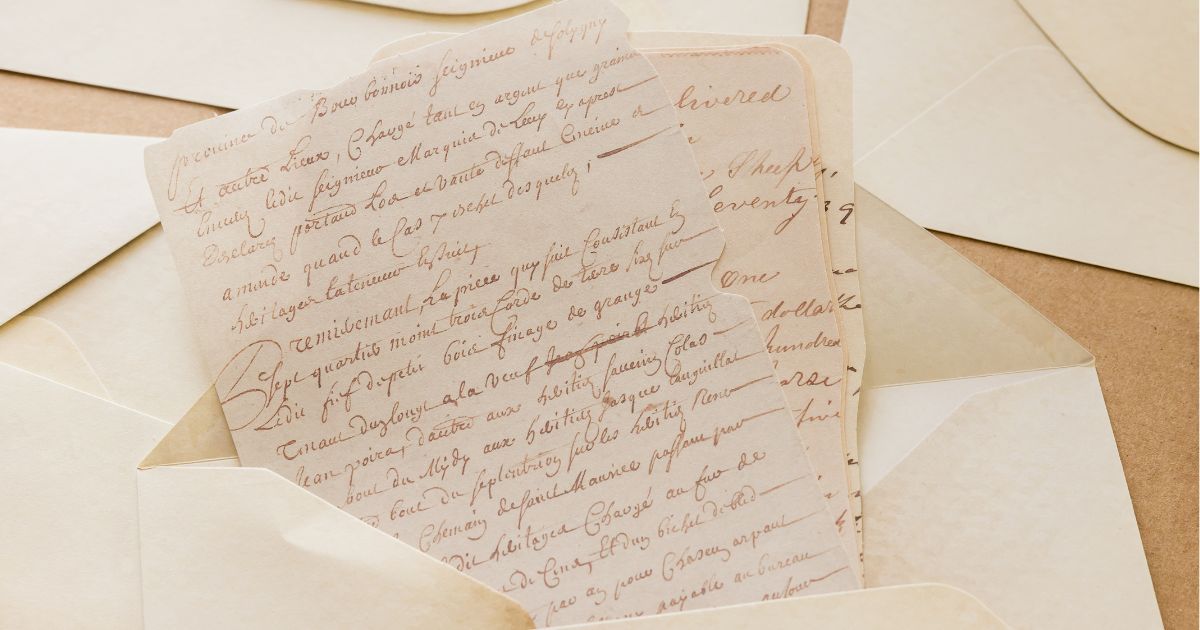

Step 9: Delivery

If the check is meant to be mailed, fold it neatly and insert it into an envelope. Address the envelope properly and add any necessary postage. If it’s a personal check, it’s generally considered more secure to hand it directly to the recipient.

Step 10: Monitor the Clearing of Funds

Finally, after sending or handing over the check, it’s crucial to monitor the clearing of funds. Make sure you have sufficient funds in your account to cover the check amount. Keep an eye on your bank statements or online banking platforms to ensure the check has been processed and cleared successfully.

In conclusion

And there you have it! Writing a check is a simple process that just requires a few key steps. Remember to date the check, fill in the payee and amount, sign it, tear it out carefully, and keep accurate records. By following these steps, you can confidently write checks whenever you need to. Now go ahead and put your newfound check-writing skills to good use!

Goodbye, and we hope you found this article helpful!

Originally posted 2023-07-09 18:20:22.