Why Is RAM So Expensive – RAM pricing has become one of the most confusing topics in the PC hardware world. What used to be a simple purchase decision has turned into a volatile market where prices jump quickly and availability feels unpredictable. While artificial intelligence plays a role, the reality behind expensive RAM is far more complex than most people realize.

This article breaks down why RAM prices are rising, who is driving demand, and why consumers are feeling the impact across PCs, smartphones, and even GPUs.

RAM Prices Are No Longer Predictable

Not long ago, buying RAM was straightforward. You chose a capacity, matched the speed with your motherboard, installed it, and moved on. If prices felt high, you waited for a sale. That simplicity is gone.

Today, memory pricing fluctuates rapidly, making RAM one of the most unstable components in the entire PC ecosystem. What looks like a temporary price spike is actually the result of long-term structural changes in how memory is produced, allocated, and sold.

The Global DRAM Market Is Extremely Concentrated

Only Three Companies Control Most RAM Supply

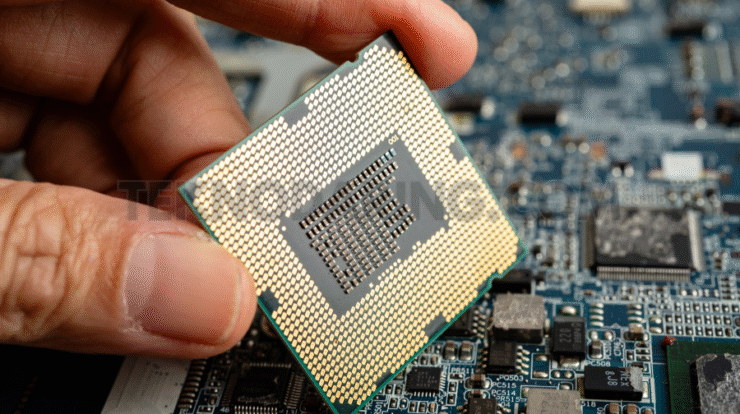

Modern system memory—DDR4, DDR5, LPDDR, GDDR, and HBM—all rely on DRAM technology. Despite different use cases, they share the same manufacturing pipeline.

More than 90% of global DRAM production is controlled by just three companies:

- Samsung

- SK Hynix

- Micron

This level of concentration means any shift in strategy by these manufacturers has immediate global consequences.

Older Memory Standards Are Being Phased Out Faster Than Demand Drops

DDR4 and LPDDR4 Are Becoming Scarce

Before AI demand exploded, memory makers were already planning to retire older production nodes. DDR4 and LPDDR4 were built on aging processes that deliver lower profit margins.

Manufacturers began issuing end-of-life notices for these products, pushing customers to secure supply early. Instead of prices falling as expected, shortages appeared—and costs went up.

This has led to a strange situation where older RAM types are getting more expensive, not cheaper.

AI Has Reshaped Memory Priorities

High-Bandwidth Memory Is Taking Over

AI workloads rely heavily on High Bandwidth Memory (HBM), a specialized form of DRAM stacked vertically for extreme performance. GPUs used for AI training and inference require massive amounts of it.

Every wafer allocated to HBM is a wafer not used for:

- Consumer DDR5

- Laptop LPDDR5X

- Graphics GDDR6

Once hyperscalers and AI firms locked in long-term contracts, memory manufacturers followed the money.

Consumer RAM Is No Longer the Priority

Servers and Data Centers Pay More—and Guarantee Volume

Selling memory to data centers offers manufacturers:

- Higher profit margins

- Predictable long-term contracts

- Lower retail overhead

By comparison, consumer RAM sold through retail channels looks far less attractive.

As a result, PC DDR5 kits that were affordable months ago now carry premium pricing, sometimes rivaling major component upgrades.

Spot Prices and Contract Prices Are Rising Together

A Sign of Severe Supply Pressure

- Spot prices reflect short-term DRAM chip trading

- Contract prices reflect long-term OEM agreements

When both rise sharply at the same time, it signals widespread supply constraints.

Currently:

- Notebook memory contract prices are climbing in double digits

- DDR5 spot prices are rising far faster than seasonal norms

- Even DDR3 and DDR4 pricing continues to increase

There is no “safe” memory category right now.

Micron’s Exit Made Things Worse

The Loss of Crucial Reduced Consumer Competition

Micron’s decision to exit the consumer memory and storage market effectively ends production of Crucial-branded RAM and SSDs.

Crucial acted as a price stabilizer, keeping competitors in check. With Micron shifting focus entirely to enterprise and AI customers, consumer options shrink even further.

After early 2026, Samsung and SK Hynix will be the only major suppliers left serving consumer DRAM at scale—never a recipe for lower prices.

Server Memory Is More Profitable Than Consumer RAM

Samsung and SK Hynix Follow the Margins

Manufacturers are now prioritizing:

- DDR5 RDIMM server memory

- Enterprise-class modules with high capacity

These products deliver massive margins with fewer risks than consumer-grade DIMMs. As production shifts toward servers, supply tightens elsewhere—pushing prices higher for everyone.

The Ripple Effect: GPUs, Phones, and SSDs

RAM shortages don’t stop at desktops:

Graphics Cards

- GDDR6 prices are rising

- Entry-level and midrange GPUs are getting more expensive

Smartphones

- LPDDR memory costs are increasing

- Entry-level devices remain stuck at 4GB RAM

Storage

- NAND flash is being redirected toward enterprise demand

- Consumer SSD prices are slowly creeping upward

What Happens Next?

OEMs Are Already Warning Consumers

Major manufacturers are preparing customers for price hikes:

- PC vendors are planning double-digit system price increases

- Laptop quotes are becoming shorter-lived

- Enterprise hardware costs may rise further into 2026

This affects schools, businesses, and everyday buyers—not just enthusiasts.

Can Anything Fix the RAM Shortage?

Short-Term: Limited Relief

- Memory pooling over CXL may reduce data center demand

- Reusing older DDR4 helps enterprises—but not consumers

Long-Term: New Fabs Take Years

- New DRAM facilities cost billions

- Most new capacity won’t arrive until 2028 or later

The Big Unknown: AI Demand

If AI investment slows, memory prices could fall. But betting against AI right now means betting against one of the largest tech investment cycles in history.

Final Thoughts: RAM Is No Longer a Commodity

RAM prices aren’t rising because everyone suddenly needs more memory at home. They’re rising because the same factories now serve entirely different customers with deeper pockets and longer contracts.

Until supply expands or demand shifts, RAM will remain expensive, constrained, and unpredictable. For now, memory has gone from an afterthought to one of the most critical bottlenecks in modern computing.